Transforming degraded land into productive forests through blended finance

In a nutshell

Belterra, a Brazilian enterprise that develops agroforestry systems through partnerships with small- and medium- sized rural producers, leveraged a blended finance instrument to successfully scale its operations.

Through a combination of philanthropic capital, concessional and commercial debt, the company is successfully expanding from the management of 2,000 hectares of agroforestry systems to a target of 10,000 hectares by 2025.

This blueprint highlights Belterra’s use of a blended finance instrument and outlines the enterprise’s innovative business model. Operating through a financial support framework, through the implementation and management of agroforestry systems, Belterra delivers direct investment to small and medium-sized rural producers and assists the provision of loans from financial institutions to producers, while simultaneously generating high-integrity carbon credits.

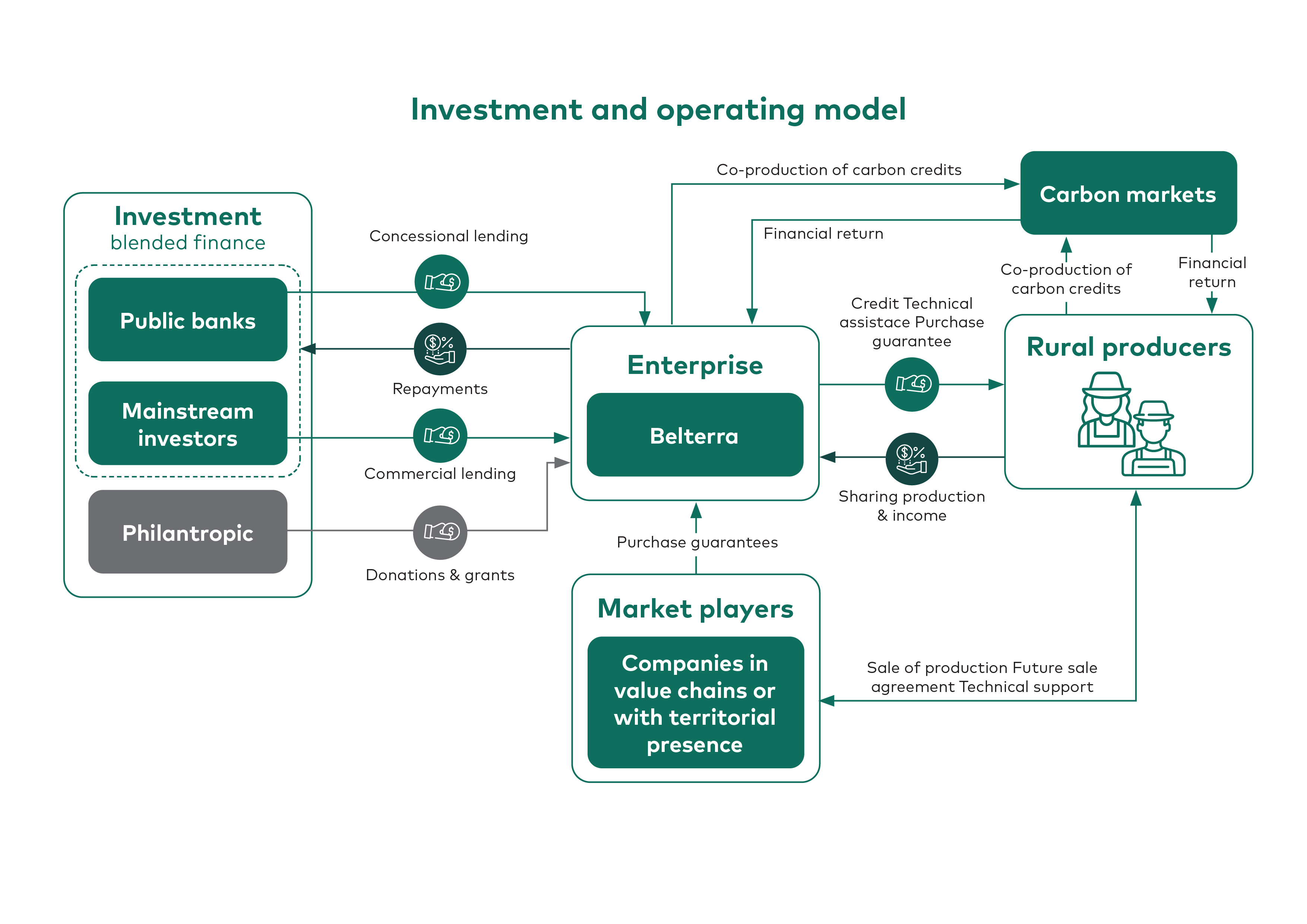

Investment and operating model

Belterra developed an innovative business model to facilitate farmers in adopting agroforestry, offering support and expertise along with access to markets through two primary service models: leasing and rural partnership contracts. These models ensure flexibility to cater to diverse producer needs. Belterra aids smallholders in transitioning to agroforestry by providing capital structuring and technical assistance, and facilitating access to environmental credits and consumer markets. Revenue primarily comes from crop sales under long-term purchase guarantee contracts with premium sales prices due to sustainable agroforestry practices. Additionally the company mobilizes financial capital for its landowners through partnerships with financial institutions, securing credit and operating as an intermediary. The integrated operation of farmers with Belterra reduces credit risk and guarantees implementation and monitoring of best production practices.

To scale its operations, Belterra utilizes a blended finance investment vehicle, pooling philanthropic and private capital, including concessional and commercial debt from mainstream investors in a layered capital structure. The sequential capital raising approach allows for phased implementation or expansion to new areas. Foundations and philanthropic partners contributed grant or catalytic capital, while a Rural Receivables Certificate (CRA) was created to engage mainstream investors, including banks and asset managers, who contributed through concessional and commercial loans with variable repayment periods of up to 10 years depending on the investor tranche. The hybrid financing, securing USD 60 million to date, defies a traditional structure, with the subordinated tranche serving as catalytic capital. Additionally, Belterra leverages financing from the generation of high-integrity carbon credits as guarantees for financing and as part of the sources of investment supporting the recovery of degraded areas.

Impact measurement

To assess the impact of its operations, Belterra uses IRIS+, a catalog of performance metrics used by impact investors to measure the impact of a business based on key indicators relating to biodiversity and ecosystems, economy and society, risk management, and governance. Key biodiversity and ecosystem indicators include area of land reforested, ecological restoration management area, and total protected land area.

Scalability and replication

Belterra envisions substantial expansion, aspiring to restore 60,000 hectares, requiring a USD 400 million investment. Belterra’s operations demand an upfront investment of around USD 10,000 per hectare over the initial three years for supplies and land management, with positive cash flow beginning in the fourth year, peaking at USD 7,000 per hectare by the 10th year. Starting in the second year, carbon credit generation is predicted to average 136 tons per hectare over a 14-year cycle, further enhancing financial performance. This model demonstrates potential for replication in developing and rainforest regions, where small- and medium-sized family farming is crucial for food security and socio-economic development.