Impact investment unlocking equity for scaling the use of agricultural by-products for sustainable livelihoods

In a nutshell

Koa, a Swiss-Ghanaian social enterprise, implemented a decentralized model centered around unutilized cocoa pulp.

By converting the pulp into valuable products like juice, concentrate, and dry powder, Koa brings circular economy elements to the cocoa supply chain, reducing waste,increasing agrobiodiversity at the farm level, and boosting income for smallholder farmers.

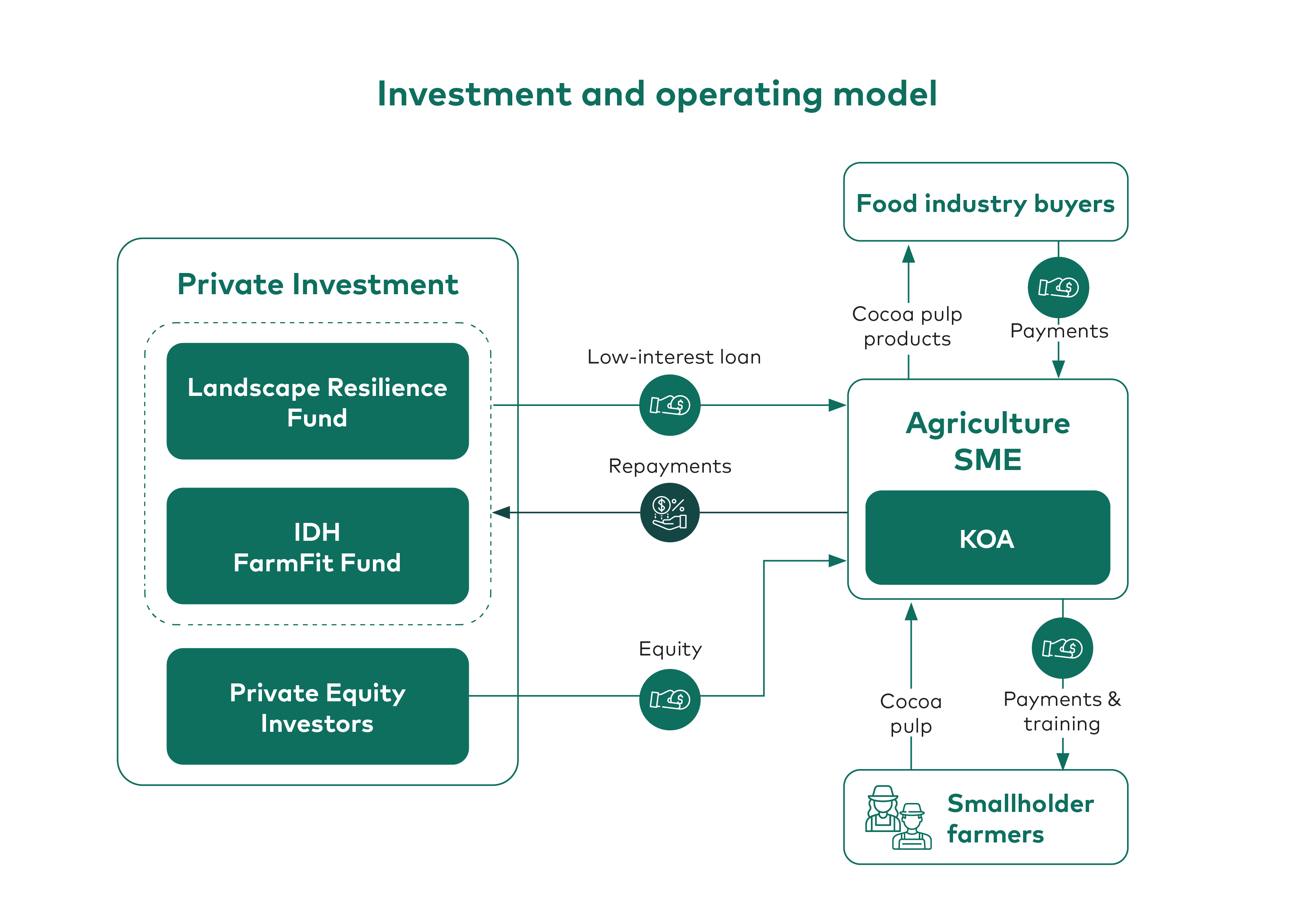

With the support of a low-interest loan from The Landscape Resilience Fund and Sustainable Trade Initiative (IDH) Farmfit Fund, Koa leveraged this financing and the technical support that came with it to attract additional commercial investments. This strategic approach not only enabled the enterprise to scale its operations through increased production but also enhanced its conservation impact.

Investment and operating model

In 2022, Koa secured a USD 3.5 million, 5-year low-interest loan from the LRF and IDH Farmfit Fund. This financing was disbursed in two tranches, and the loan, secured in Ghana, funded the establishment of a new processing facility. Preceding the disbursement, Koa obtained a letter of intent from the LRF and IDH, assuring a USD 2 million investment from a Luxembourg equity investor. Both funds required an environmental and social action plan (ESAP), targeted to enhance Koa’s environmental and social risk management and articulating bespoke impact targets.

By the end of 2023, the initial USD 5.5 million investment by the LRF, IDH Farmfit Fund, and the Luxembourg equity investor enabled Koa to attract an additional USD 15 million in equity investments. This support came from both existing and new long-term investors seeking impactful and patient risk-adjusted returns. These funds will further scale Koa’s Operations.

To date, Koa has made timely interest payments to the LRF, fostering additional investor trust. Proactive communication between Koa and investors has also enhanced trust, increasing their attractiveness to potential backers.

To date, Koa has made timely interest payments to the LRF, fostering additional investor trust. Proactive communication between Koa and investors has also enhanced trust, increasing their attractiveness to potential backers.

Impact measurement

Koa’s impact framework, involving annual monitoring and reporting, is aligned with IRIS+, a catalog of performance metrics used by impact investors. Koa’s impact framework includes improving cocoa farmers and their communities’ livelihoods, targeting 10,000 farmers by 2026, ensuring responsible production with no unnecessary harm to people and the planet, and climate-positive cocoa, including insetting and regenerative agriculture. As of the end of 2023, Koa’s smallholder farmers managed 3,150 hectares of farmland with improved practices. Koa also plans to report on its total area under restoration and conservation.

Koa utilizes GPS mapping and education to address deforestation concerns and mitigate exploitation risks in protected areas. The main conservation benefits of Koa’s operations include the promotion of sustainable agricultural practices, leading to increased agrobiodiversity at the farm level by advocating reduced chemical use, endorsing mechanical weeding, and encouraging the use of leguminous trees to enhance soil fertility.

In compliance with the ESAP, Koa aligns with governmental institutions and traders, following the International Finance Corporation’s Performance Standard 6, to prevent habitat

and biodiversity loss.

Scalability and replication

Koa’s success demonstrates how low-interest, term loans can address the financing gap for small-medium enterprises (SMEs) in the USD 0.5 – 2 million range, which is typically perceived as too risky for traditional lenders such as commercial banks, thereby providing a bridge toward commercial capital. Exploring the aggregation of relevant producers into a single funding vehicle facilitates impact at a landscape level, addressing the capital gap for SMEs.

The potential scalability of Koa’s model in the cocoa supply chain extends to regions within and beyond Ghana. Contracting farmers to sell unused cocoa pulp to players like Koa and generate revenue from processed products can theoretically be replicated worldwide. Replication is contingent on farmers’ willingness, a factor largely guaranteed by the opportunity for additional income with transparent, mobile payments. The scalable business model supports consistent revenue growth, offering diverse cocoa pulp products while benefiting biodiversity, the climate, and local communities.