Channelling private finance into nature rewilding projects

In a nutshell

Heal Rewilding, a UK nature recovery charity, developed an innovative financial model for creating of mid-scale (~500 acres) nature recovery projects in every county in England.

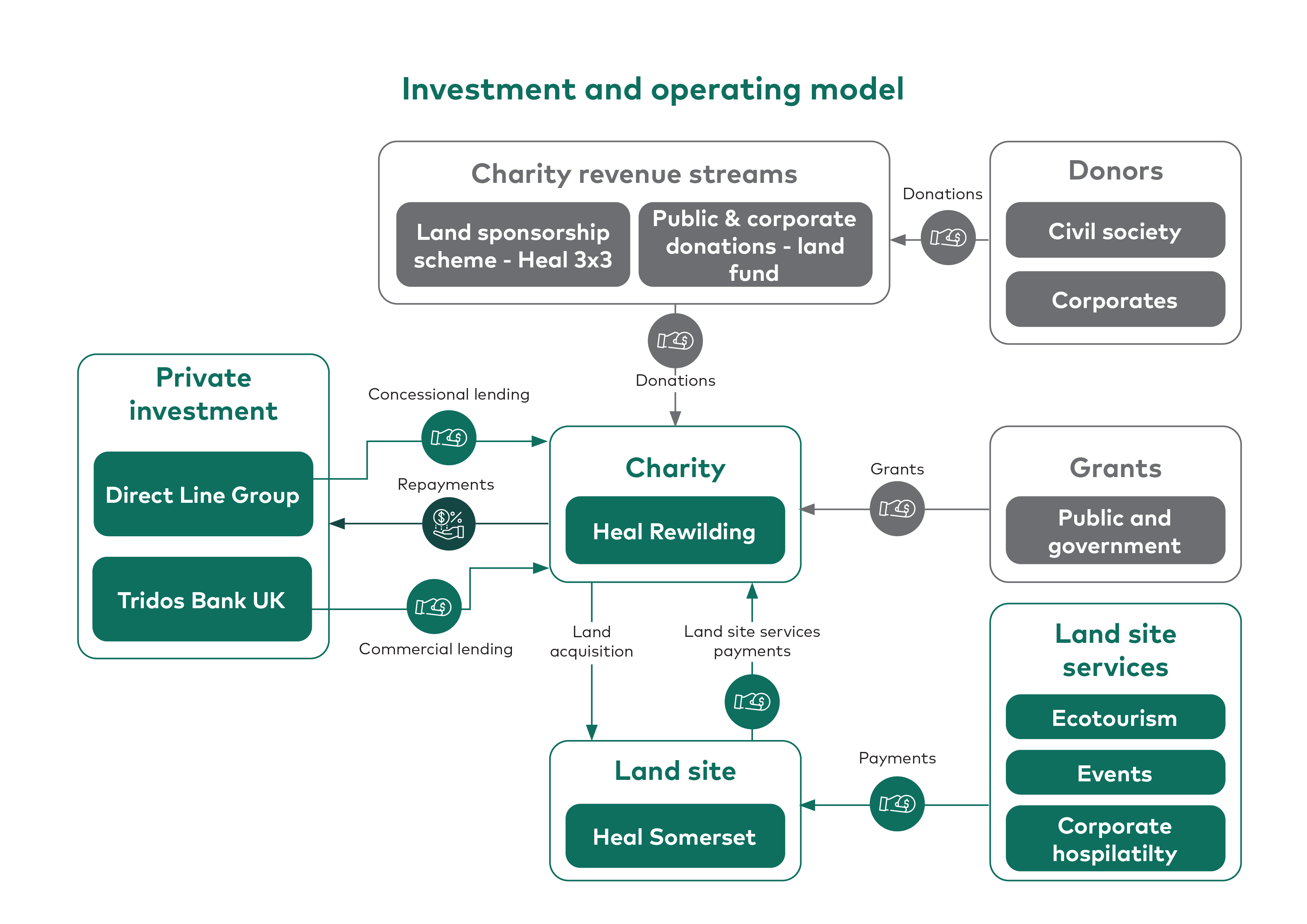

The charity leveraged a blend of concessional and commercial debt, as well as, public and private donations to acquire its first site in 2022 – Heal Somerset. To repay the loan and manage the site, Heal uses diverse repayment structures, including public and private sector land sponsorship, donations, and ecosystem services. This blueprint showcases how this blended debt structure can rapidly enable nature-led recovery projects on smaller sites.

Investment and operating model

To acquire the Heal Somerset site, a 460-acre ecologically depleted former dairy farm, the charity combined a GBP 3 million (~USD 3.8 million) concessional loan from Direct Line Group and a GBP 3.75 million (~USD 4.8 million) commercial loan from Triodos Bank UK, alongside a land fund launched by Heal in 2020, including both public and corporate donations, and Heal’s unique “Heal 3×3” land sponsorship scheme. Additionally, Heal Somerset’s commercially driven approach involves ecotourism, events, and corporate hospitality, and expects to incorporate natural capital revenues such as biodiversity credits. Through this commercial structure and additional support from individual and corporate donations, the charity aims to generate sufficient diversified revenues to pay down the finance structures used to acquire the site as quickly as possible and cover ongoing management costs.

The charity has also received a GBP 100.000 (~USD 128.000) grant from the UK Government through the Natural Environment Investment Readiness Fund (NEIRF), as well as grants from several charitable foundations. The NEIRF grant was put towards the assessment of the project’s natural capital income potential for ecosystem services, while other grants were used for charity management, running costs, and indicator species surveying. The opportunities for nature valuation are being explored alongside the potential stacking of further agri-environmental schemes, such as the UK Government Countryside Stewardship Plus. Through the NEIRF assessment of natural capital potential, the UK’s Biodiversity Net Gain (BNG) scheme, voluntary biodiversity credits, and carbon as a co-benefit of biodiversity impacts were selected as potential natural capital revenue streams for this project.

Impact measurement

As Heal Somerset is a nature-led rewilding project, with limited human intervention, it is not possible to set explicit return targets and nature recovery goals. Despite the absence of an accepted, standardized ecosystem-wide impact framework for rewilding, covering both habitat and species, Heal used the UK Government BNG Metric 4.0 to conduct a habitat assessment for BNG on the site, and is serving as a pilot for species baselining and monitoring aligned with the Rewilding Britain framework.

The project has also developed its own tiered approach to species monitoring with three levels of possible species baselining. Certain suppliers aiming to serve voluntary biodiversity markets have proprietary frameworks but until the credit market develops a sector-accepted lead framework, the project will continue gathering data based on a suite of metrics in line with the Rewilding Britain framework. For any framework that becomes established, the project expects to adapt its impact measurement accordingly. This will likely include those developed through the British Standards Institution’s Nature Investment Standards Programme.

Scalability and replication

Heal aims to establish 25,000 acres for nature recovery across a series of sites in each of the 48 English counties. Its strategic goal involves partnering with organizations that can contribute GBP 20-40 million (~USD 25.5 – 51 million) in the next 1-2 years, and recognize land as a unique asset class, thereby accelerating site portfolio development with concessional lending and equity investment. Heal is exploring the creation of a special-purpose vehicle to secure financial capital at scale through equity investments and strategic collaborations with private entities and investors, while preserving its non-profit status. As a charity, Heal prioritizes attracting impact lending over maximizing investors’ returns to cover upfront acquisition and restoration costs. Learnings from developing the Heal Somerset revenue and investment mechanisms will inform future Heal Rewilding sites and other projects focused on nature-led recovery, including in European countries where similar land models are in place. Private sector investment enabled swift site acquisition, and additional impact lending will be pivotal for establishing future rewilding sites.