Channeling private finance into habitat banking schemes in England

In a nutshell

Finance Earth and the RSPB designed an innovative financing solution to address biodiversity concerns associated with new housing developments in England.

They introduced a habitat banking mechanism, streamlining compensatory payments from developers to local councils into an established habitat bank at a designated site. Unlike traditional ‘in lieu’ schemes, this proactive approach enabled the creation of compensatory habitats before damage occurs, reducing the risk of a net loss in the cirl bunting population.

This initiative exemplifies a successful public-private-philanthropic partnership, offering a model for future compensation-based revenue streams through habitat banking with clear delivery of biodiversity benefits. This blueprint highlights the RSPB’s use of a commercial debt instrument to refinance the acquisition of its habitat banking site, enabling delivery of habitat restoration in advance of income receipts, and freeing up the charity’s cash reserves to support its wider conservation efforts.

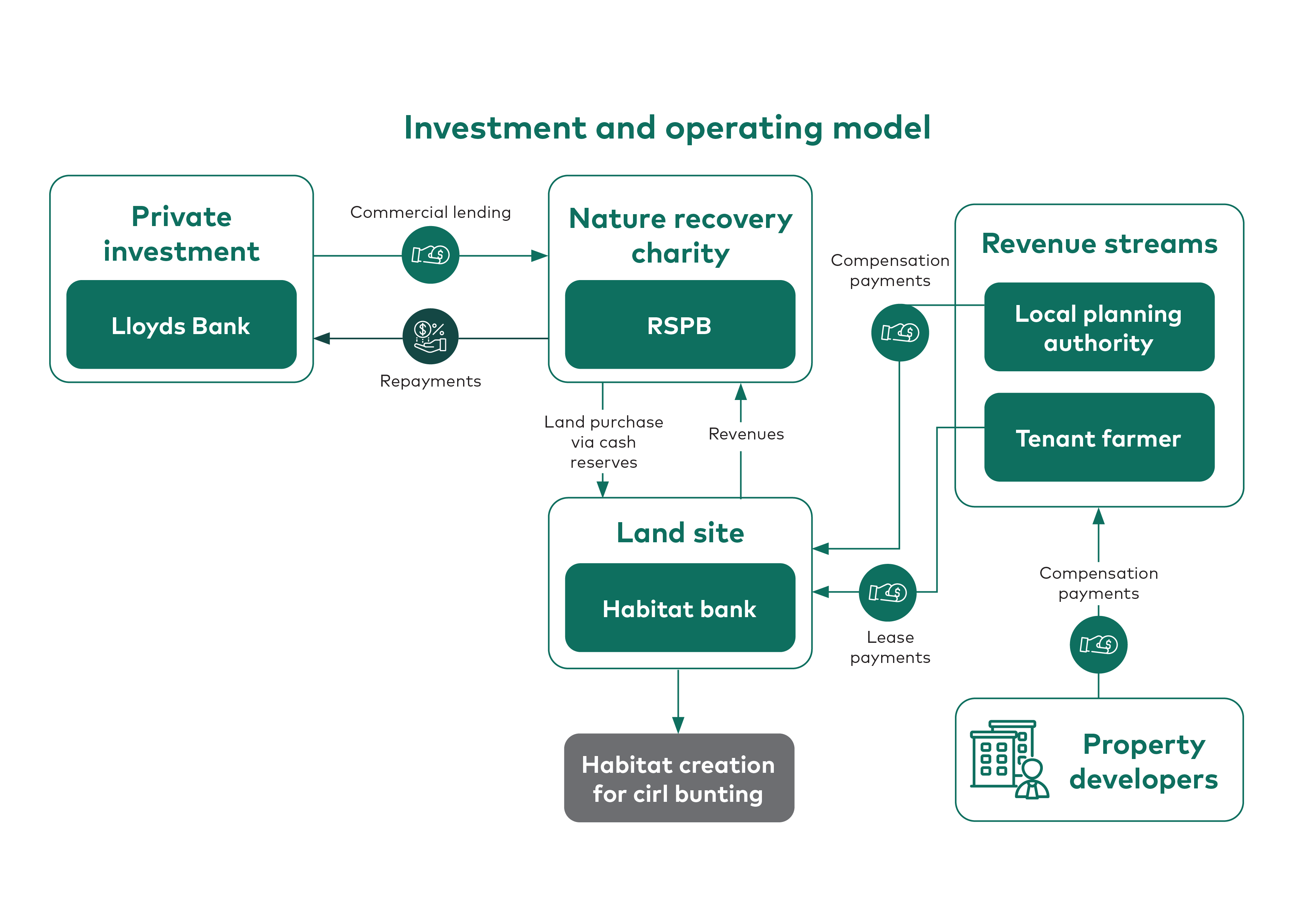

Investment and operating model

The RSPB employs a habitat banking model at the Ashill site, combining mandated compensation payments from housing developers, as a primary income source, with farm tenancy income as additional income to create a diversified revenue stream. The additional revenue stream – lease payments – and its co-benefits for the cirl bunting habitat enhanced the project’s commercial appeal to all stakeholders, including the lender and the local council. This approach enabled the RSPB to secure commercial debt finance to refinance habitat restoration, supporting the cirl bunting with long-term income generated for site maintenance.

The RSPB used its cash reserves to acquire the 37-hectare Ashill farm in Devon in 2017. The land acquisition was refinanced in 2020 through a commercial, unsecured term loan of GBP 0.5 million (~USD 0.6 million) from Lloyds Bank with a floating interest rate and regular repayment fee. The loan is repaid over five years using the site’s expected revenue streams of Section 106 funding from the local planning authority and farm business tenancy agreements.

This short-term debt-based investment was selected partly due to the predicted income streams and the RSPB’s well-established relationship with Lloyds Bank, ensuring a cost-effective rate. For the first five years, the fixed lease payments will cover interest payments on the term loan, with subsequent payments contributing to ongoing monitoring and management expenses. This financial structure allowed the RSPB to transition from a traditional ‘donative income’ approach for nature restoration that relies only on RSPB cash balances, allowing a more efficient financial structure.

Impact measurement

A set of performance metrics relating to the cirl bunting population was required by the grant agreement established between the RSPB and the local planning authority for the transaction of compensation payments from housing developers. Compensation payments were calculated by the local planning authority, where 2.5 hectares for compensatory habitat is required for each pair of cirl bunting lost to any development.

The RSPB agreed with the council to increase the number of cirl bunting at the site by at least 14 breeding pairs and maintain the site as a nature reserve. The RSPB carried out an initial baseline of the site at acquisition and a winter survey after the first year to identify the number of cirl bunting on the land. Ongoing monitoring involves a sample monitoring program by RSPB-trained volunteers. National surveys also now take place every 10-12 years, with the next planned for 2028. Demonstrating improvement of the breeding population of cirl buntings at Ashill is essential evidence that the compensation payments made by the local authority are delivering on the required benefits for the species.

Scalability and replication

The project has been delivered, with the initial five years of restoration completed in December 2023. RSPB is due to enter a new agri-environment scheme for further enhancement over the next five years to support wildlife to thrive on the site. With the mandatory implementation of the Biodiversity Net Gain (BNG) policy enforced in England in 2024, a similar financing approach could be replicated to create habitat banks to deliver biodiversity gains to compensate for development impacts across England, and in jurisdictions with compensatory payment requirements. The availability of a methodology for calculating the biodiversity enhancement required – the Defra statutory biodiversity metric – enables measurement and comparison of interventions. The model serves as a blueprint for how private investment could deliver large-scale habitat restoration in advance of development impact to achieve biodiversity benefits.