Channelling private finance into Marine Protected Areas

In a nutshell

Coral reefs provide exceptional biodiversity and benefits to humans and are threatened by unsustainable fishing, careless tourism, pollution, and coastal development. Marine Protected Areas (MPAs) are among the most effective tools in reducing those threats but they often lack adequate financing.

To address this challenge, and create an investable structure that attracts private sector investment, Blue Finance has developed a collaborative management partnership model for MPAs.

The associated risk is compounded by a gap in insurance coverage, leaving vulnerable communities and government agencies underprotected in the face of ever more frequent and severe extreme events. One new financing mechanism to bridge this gap and increase both physical and financial protection is the resilience bond, a variation on conventional catastrophe bonds. Resilience bonds value the reduction in disaster-related expected loss from the implementation of resilience projects through a rebate structure.

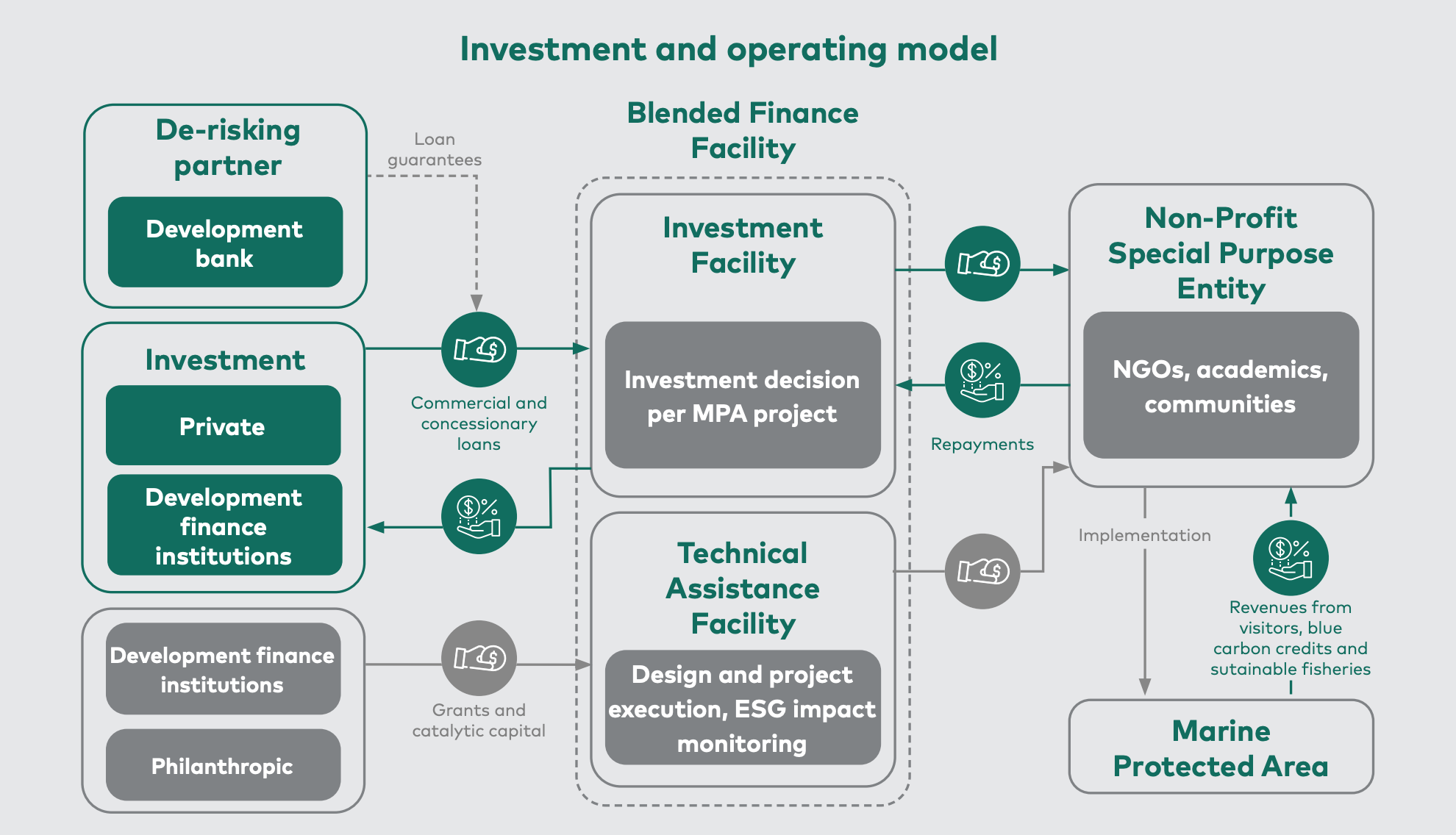

Investment and operating model

The approach relies on an innovative management lease for MPAs with tangible revenue models, leveraged by blended finance and empowering local communities. A 10-year public-private partnership (PPP) is arranged between a non-profit co-management entity (Special Purpose Entity, SPE), formed by a coalition of NGOs, scientific organizations, and community associations, and the government that designated the MPA.

The SPE receives a blend of debt and grants for initial capital expenditures from impact investors and donors. Development finance institutions provide derisking options to improve the model’s attractiveness. The SPE enhances biodiversity and implements community development activities. It generates income for MPA management and creates investor returns from a range of sustainable and tangible finance tools, including fees paid by visitors, innovative eco-tourism, sustainable fisheries and blue carbon credits. All surplus is reinvested into the MPA.

The government agencies involved in the project maintain their core functions and are responsible for the regulation of use, zonation, and validation of the annual work plans and budgets, their enforcement, compliance, and the management of fishery resources.

Impact measurement

Improvements in coral reef ecosystem health will be tracked using indicators such as coral abundance, diversity, fish population density and diversity, macroalgal abundance, and water quality. In addition, local communities of small-scale fishermen will benefit from the new income-generating activities in the MPA, as well as from increased fishery productivity. Additionally, new opportunities in small-scale eco-tourism activities may also enhance the MPAs and contribute to community livelihoods.

Scalability and replication

Current projects exist in the Caribbean. Globally, the approach is scalable to MPAs with a tangible business model, under collaborative management, and with entrepreneurial capacity (of which there are approx. 200 worldwide). The initial up-scaling will be achieved through structuring a blended finance facility for 20 MPAs by 2030 (USD 50m target).